In a highly significant revelation, Dr. Abdulqadir al-Husriya, Governor of the Central Bank of Syria (CBS), outlined the advent of a new economic phase the country is experiencing after the lifting of Western sanctions. He emphasized that “the world’s trade doors are now directly open to Syrians,” which will have a tangible positive impact on citizens’ lives.

Opening the Doors to the World

Husriya described the lifting of sanctions as “the most important achievement, as they were the most severe in the world,” noting a radical shift in Syrians’ ability to export and import directly without barriers. He emphasized that this step is returning Syria to a “free economy model,” where the state bears the duty of serving citizens, free from exploitation.

A set of important financial reforms were announced aimed at reintegrating Syria into the global financial system. These include Syria’s return to the SWIFT system, which will enable it to resume international banking services directly and without the need for intermediaries.

Cooperation with international institutions will also be pursued, with effective communication initiated with the World Bank to authorize direct transactions between Syria and the bank without the need for intermediary banks.

Negotiations will also be underway to return frozen funds by exerting full efforts to reactivate Syria’s frozen accounts in Western banks. A strategy is under development to engage with major banks such as the US Federal Reserve and Arab and European central banks, although this process will require time to build trust after years of sanctions.

A Vision for the Future: Financing, Transparency, and Stability

The CBS Governor announced a series of priorities aimed at enhancing financial and economic stability in Syria. The bank will focus on facilitating real estate and housing financing by developing long-term, affordable real estate financing mechanisms, while utilizing Islamic finance and Arab and European development funds to provide soft loans.

It will also focus on protecting the economy from global fluctuations by avoiding the economic dependence on global markets and the exhaustion that has afflicted other countries in the past. It will also regulate exchange operations and enhance transparency by calling for the regulation of exchanges within a legal and declaratory framework issued by the Central Bank.

The Central Bank emphasizes the need to be an “independent monetary authority.” Finally, it will launch a strategic monetary objective by working to establish a “unified price ceiling” and build a financial sector serving both the private sector and citizens, leveraging Syria’s economic diversity and rich human resources.

International Technical Support

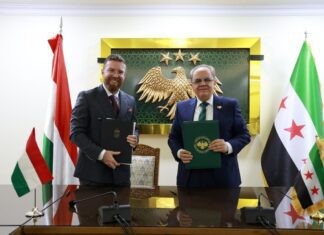

Husriya explained that Syria’s dealings with the International Monetary Fund (IMF) and the World Bank are limited to “technical matters,” providing only consultations without interfering in policy matters. He revealed that Syria had received a “$147 million grant, not a loan,” acknowledging the key role of Syrian diplomacy in removing sanctions.