Syria will be reconnected to the international SWIFT payment system within weeks, marking a major step in the country’s attempt to revive its economy and reintegrate with global markets after more than a decade of war and isolation, according to Central Bank Governor Abdulqader Husrieh.

The return to SWIFT, confirmed in an interview with the Financial Times (FT) published Monday, represents the first major economic milestone for the transitional government that replaced the Assad regime last December. The move comes just weeks after the US lifted sanctions, opening the door for Syria to resume financial transactions and attract international investment.

Banking Reform at the Core of Economic Recovery

Husrieh, who took office in April, said the central bank has laid out a detailed six-to-twelve-month plan to restructure Syria’s monetary policy and banking sector. “We aim to enhance the brand of the country as a financial hub given the expected foreign direct investment in rebuilding and infrastructure—this is crucial,” he told the Financial Times.

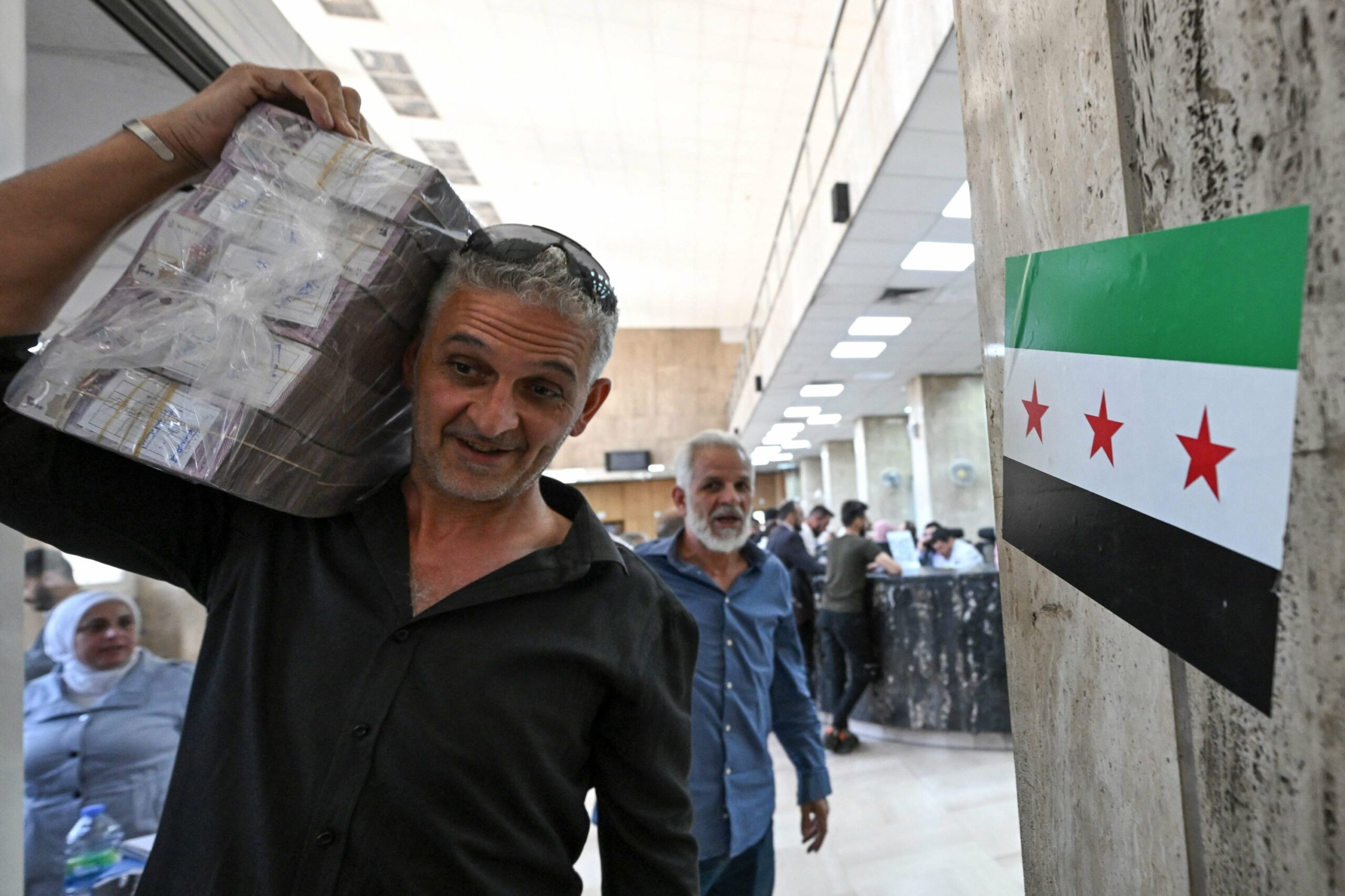

The reforms are designed to reverse years of rigid economic control under the previous regime, which micromanaged the financial system, limited lending, and imposed severe restrictions on withdrawals. Husrieh’s plan includes recapitalizing banks, easing regulatory constraints, and restoring their function as intermediaries between businesses and households.

To support private sector stability, the central bank intends to create a new state institution to guarantee private bank deposits, while continuing to back the public banking sector. These measures, officials say, aim to restore trust in formal banking and encourage Syrians in the diaspora to invest at home.

Currency Stabilization and Trade Liberalization

Syria’s battered currency, which according to the FT lost, roughly 90% of its value before Assad’s ouster, remains volatile. Husrieh said the bank is transitioning toward a managed float and working to close the gap between the official and black market exchange rates. Reestablishing the SWIFT system, he added, will help reduce the country’s reliance on informal money transfer networks, which have been costly and vulnerable to corruption.

“The plan is for all foreign trade to now be routed through the formal banking sector,” he said, noting that informal channels were charging up to 40 cents per dollar. Formalizing transactions is also expected to strengthen anti-money laundering measures and streamline aid disbursement, which had been impeded by sanctions and the absence of SWIFT.

International Partners Signal Support

While the government has ruled out borrowing, it is exploring the issuance of Islamic sukuk, an Islamic financial certificate, similar to a bond in Western finance, to raise capital without violating religious prohibitions on interest. The World Bank and International Monetary Fund have both sent delegations to Damascus for preliminary talks. Meanwhile, Saudi Arabia and Qatar cleared Syria’s $15.5 million debt to the World Bank and pledged to fund public sector salaries for at least three months.

Despite challenges, the transitional government appears determined to accelerate reforms. “We’ve seen license issuance and selective sanctions relief,” Husrieh said. “But for real change, implementation must be comprehensive.”